Why we need Multi-Chain Liquidity

As users spread assets across more chains, the real challenge isn’t just bridging - it’s keeping liquidity available onchain, where it’s actually needed.

Supporting deposits and withdrawals across chains usually means manual operations: rebalancing collateral, coordinating bridges, centralized liquidity pools and complex operational setups.

Hyperlane Warp Routes 2.0 removes all that overhead. It lets apps tap into liquidity from multiple chains at once and uses native rebalancing to keep things flowing smoothly. No central hubs, no custom routing, no friction for users or developers.

With Hyperlane Warp Routes 2.0, chains and apps can:

- Accept assets from multiple source chains

- Eliminate liquidity fragmentation with native rebalancing

- Offer a smooth UX without complex cross-chain operations

In this post, we’ll cover:

- Introduction to HWR & HWR 2.0

- What’s native rebalancing and how does it work?

- How to get started

From Single-Chain Bridges to Multi-Chain Liquidity

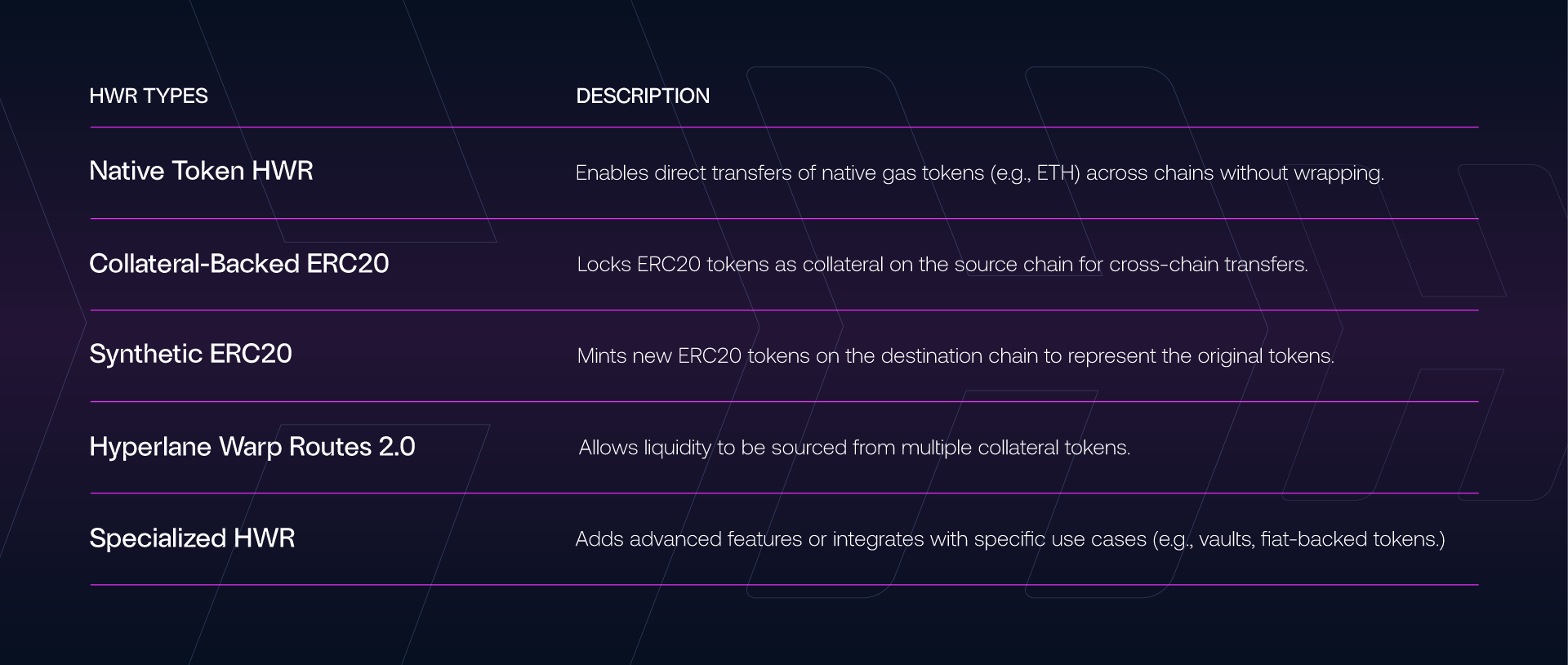

Let’s first take a step back and cover Hyperlane Warp Routes (HWR) 1.0.

HWR 1.0 are modular cross-chain bridges that let you move assets between chains using Hyperlane’s general message passing protocol.

HWR 1.0 let deployers choose how tokens are transferred between chains. Depending on the type of route, contracts will lock tokens, mint wrapped tokens, burn wrapped tokens, or release original tokens.

For example:

- Collateral → Synthetic: Tokens are locked on the origin (collateral) chain, a message is sent, and wrapped tokens are minted on the destination (synthetic) chain.

- Native → Synthetic: Native gas tokens (e.g., ETH) are locked on the origin chain, a message is sent, and synthetic tokens are minted on the destination chain.

- Native → Collateral: Native tokens are locked on the origin chain, a message is sent, and collateral tokens are released on the destination chain.

As liquidity gets fragmented across the multi-chain ecosystem, users need more flexibility.

Warp Routes 2.0: Built for the Multi-Chain Reality

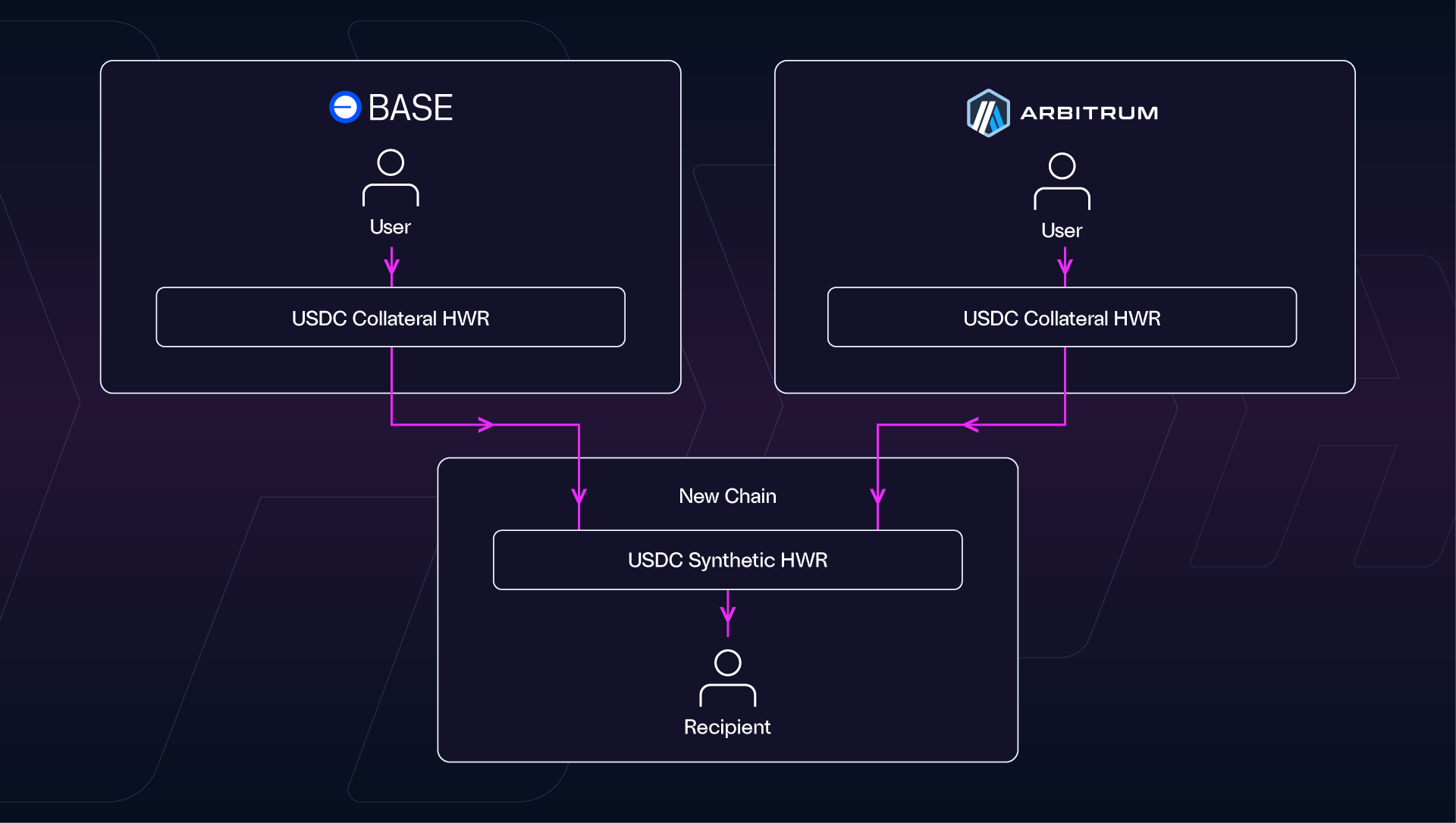

HWR 2.0 introduces multi-collateral support with native rebalancing, enabling liquidity to be sourced from multiple chains at the same time.

To make this more concrete, here's what a HWR 2.0 can look like:

- Lock 50 USDC on Base

- Lock 50 USDC on Arbitrum

- Mint 100 wrapped USDC on NewChain

This multi-source setup unlocks a smooth user experience where users can bridge directly from the chain they're on - without first needing to route through a central “collateral hub” chain.

With this added flexibility comes a new challenge: How do you manage liquidity across multiple collateral chains?

If deposits and withdrawals aren't balanced, it could lead to collateral imbalances. For example, if more users are withdrawing on one chain than depositing, that chain can run out of tokens and cause withdrawal failures.

This is where the Native Rebalancing feature of HWR 2.0 comes in. Let's dig into how it works.

Solving Liquidity Imbalance: Native Rebalancing

To keep liquidity balanced across multiple chains, HWR 2.0 introduces a new agent: Rebalancer, as well as upgraded smart contracts which enable this new functionality.

The Rebalancer

The Rebalancer is a managed service by Abacus Works (core developer team of Hyperlane) that continuously monitors and manages collateral across all chains in the HWR. It uses external/native bridges like CCTP or protocols like Everclear to automatically move funds between chains, maintaining optimal liquidity distribution.

For example, lets say users are frequently depositing on Chain A and withdrawing on Chain B, the Rebalancer detects this imbalance and moves liquidity from Chain A to Chain B to keep everything flowing smoothly.

This behind-the-scenes coordination allows the HWR to remain functional and capital-efficient without any operational overhead.

Why HWR 2.0

HWR 2.0 acts as an onchain liquidity layer that abstracts away the complexity of managing and rebalancing collateral across chains - so apps can offer smooth cross-chain flows without custom infrastructure.

Whether you’re launching a new chain or scaling an existing one, here’s what becomes possible:

For New Chains

- Launch with instant liquidity from multiple chains: Accept deposits from multiple chains without custom setup.

- No extra setup: If you have a Hyperlane deployment, you can start using HWR 2.0. No new custom contracts or setup required.

- Onchain and automated: Rebalancing and routing happen under the hood with no added operational overhead.

- Avoid reliance on centralized liquidity hubs: Liquidity can be sourced and balanced natively across chains.

For Users

- Bridge from anywhere: No need to bridge assets to a specific chain first.

- Withdraw to the chain you actually want to use: Get your tokens where they’re useful to you

- No manual routing or extra approvals: Users interact with a single flow, the collateral logic is handled behind the scenes.

- Consistent experience across chains: The deposit and withdrawal UX stays the same on different chains.

Ready to try it out?

Stay tuned for an announcement about the initial HWR2.0 routes…

Want to launch your own HWR2.0s? Get started in the Hyperlane Docs.

About Hyperlane

Hyperlane is the open interoperability framework. It empowers developers to connect anywhere onchain and build applications that can easily and securely communicate between multiple blockchains. Importantly, Hyperlane is fully open-source and always permissionless to build with.

.png)